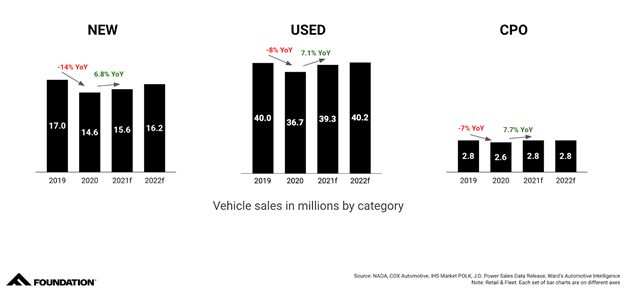

Forecasts Point to a Bright 2021 As Automotive Sales Rebound

Various analysts across the auto industry, including IHS Markit, Wards Auto, Cox Automotive, J.D. Power, and NADA, have released their new and used vehicle sales forecasts for 2021. We’ve collected the forecasts to paint a picture of what lies ahead for automotive sales in the new year.

Here is a breakdown of trends to watch in the new and used market.

Three Reasons Car Dealers Can Be Optimistic for New Sales Recovery in 2021:

- Better Than Expected Rebound – At the beginning of 2020, NADA forecasted 16.8M new vehicle sales,1 but once COVID hit, they reevaluated their forecast in April to 13.5M.2 2020 ended with 14.6M new vehicle sales,3 showing that the 2nd half exceeded expectations.

- Recovery Continues – With vaccines and stimulus checks rolling out to the country, NADA expects retail and fleet sales to continue to recover, forecasting around 15.5M new sales in 2020 and over 16M for 2022.4

- Low Rates to Stay – The Federal Reserve has said they have no plans to raise interest this year, which will keep rates low into 2022.5

While new vehicle sales recovery looks promising, inventory remains dynamic and uncertain. Dealers need to monitor inventory and align advertising to focus on vehicles currently in stock. Foundation Direct’s solution is designed to save dealers time and money to generate ads based on dealer inventory in real time, never wasting money on out-of-stock vehicles.

Automotive brands pulled back marketing spend -22% YoY in 20206 while sales declined -14.5%.1 Starting in the new year, dealers should audit budgets across all profit centers and make sure they have scaled back up to meet the return in demand.

Three Reasons Car Dealers Could See an Increase in Used Sales in 2021:

- Vehicle Affordability

Increasing average transaction prices for new vehicles are pushing buyers to look at used — in December 2020, new vehicle transaction prices hit a record high.7 This is causing new car shoppers to consider used or CPO vehicles more than they have in the past — 59% of new car purchasers considered used or CPO vehicles, up from 48% pre-COVID.8 - Available Inventory

The emerging semiconductor shortage will further constrain new vehicle production. When new inventory was constrained last year, we saw used vehicle sales outpace new sales, and this has continued as we enter 2021.9 - Pent-Up Demand

Used vehicle sales may increase as much as 30% from Feb.-April during tax season.10 Buyers who planned to use their tax refund to buy a vehicle in 2020 may have been delayed due to COVID. We may see that pent-up demand carry over to this tax season.

Is your dealership’s advertising spend appropriately supporting all profit centers? Foundation Direct clients’ average Paid Search budgets are distributed 54% for new, 38% for used, and 8% for service,11 which aligns to share of sales revenue by dealers reported by NADA at 53% new, 35% used, 12% service.12 At Foundation Direct, we give dealers full transparency, control, and flexibility to adjust their media budgets at any time while also generating custom ads for every vehicle a dealer has in stock. Contact us for more information.

Contributors:

Michael Heidner |

Ashley Lepczyk |

Peter Leto |

Sources:

1Autonews.com “U.S. new-vehicle sales to fall to 16.8M in 2020, NADA says”

2Autonews.com “NADA slashes forecast for 2020 auto sales”

3Autonews.con “Q4 sales fall 2.4%; 2020 finishes down 14%”

4Nada.org “NADA Issues Analysis of 2020 Auto Sales, 2021 Sales Forecast”

5CNBC.com “Fed sees interest rates staying near zero through 2022”

6MarketingDive.com “Ad spend retraction due to COVID-19 worse than expected: WARC”

9TrueCar’s ALG Forecasts January 2021

10COX Automotive “Cox Automotive Commentary: First-Half 2020 U.S. Auto Sales”

11Foundation Direct Internal Data, 2021. Average account budgets across New, Used and Fixed Ops profit centers