Marketing at the Speed of Consumer Demand and Dealer Inventory

Heading into a slew of sales events in the coming months, the trends are pointing toward a continued strong rebound for automotive sales in 2021 — April 2021 is forecasted to be a record-breaking month¹. Vehicle sales will only continue to rebound as we head towards Spring sales and Memorial Day — which is one of the top sales events of the year — right into Summer sales events, driving demand from the 4th-of-July through Labor Day. Consumer demand will continue to rise despite inventory constraints. Industry experts are increasingly bullish for 2021 sales as forecasts that we collected in the beginning of the year have already been adjusted for 2021.

The fact: Buyers are going to find a way to purchase a vehicle in the coming months regardless of inventory, price or vehicle color even if it is less desirable.

(like a Starbright Yellow KIA Seltos 😆) Is your dealership going to be there to capture demand?

Three reasons why quickly adapting to consumer demand and marketing your available inventory in the coming months is crucial:

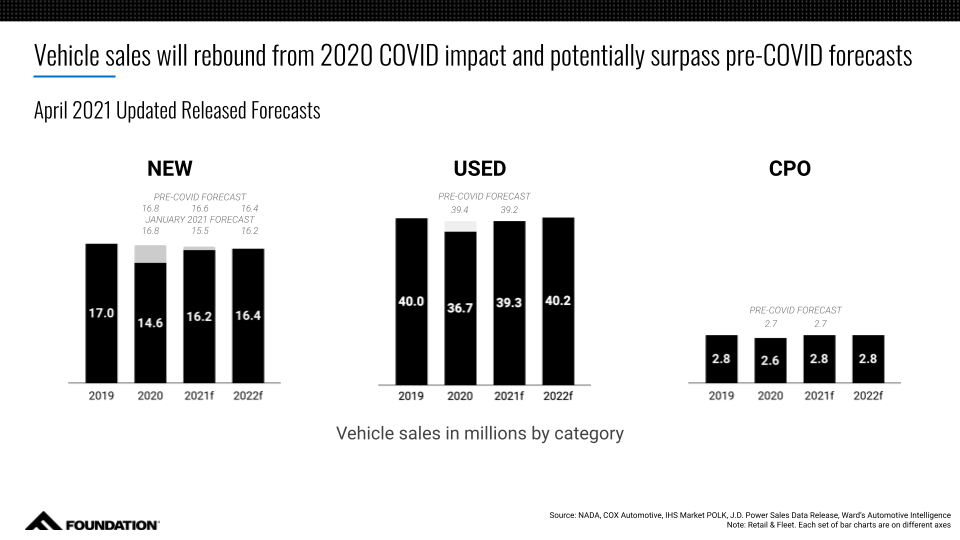

- Demand is high and forecasts for 2021 vehicle sales are trending even more favorably than just 3 months ago:

- NEW VEHICLE SALES FORECASTS: Increased 0.7M units above the initial 15.5M forecast to 16.2M for 2021. Forecasts for 2022 have bumped up 0.2M units to 16.4M, surpassing pre-covid forecasts².

- USED VEHICLE SALES FORECASTS: 2021 used sales forecasts were already above forecasts that came out pre-covid, displaying how hot the used car market has been. The industry has a chance for nearly 40M used vehicles sold in 2021 at the current pace².

- Inventory and transaction prices are heavily influencing in-market shopper behaviors: The semiconductor chip shortage drove New Vehicle days’ supply to 39 in the end of March 2021³ — the lowest since cash-for-clunkers back in 2008. Meanwhile, Used Vehicles are seeing record demand and transaction prices⁴. Consumers want to buy vehicles and will adapt behaviors to find a way to purchase one and we are seeing it in the data:

-

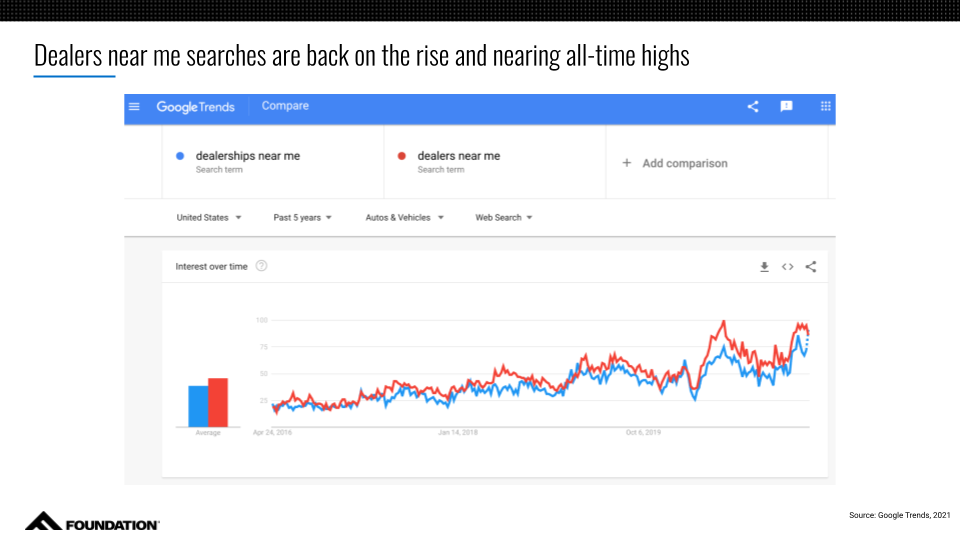

- Searches for Dealers Near Me are back on the rise and hitting new record highs as people are open to searching multiple dealers to find a vehicle⁵. This points to an overall increase in lower-funnel intent in the marketplace.

- Cross-shopping between New and Used Vehicles is growing as 59% of New Vehicle purchasers now consider Used or CPO vehicles, up from 48% pre-COVID⁶. These profit centers working together is key as people jump between the two segments.

- People are paying record prices for new and used vehicles to get what they want as transaction prices are at record highs⁷. Buyers are even willing to purchase vehicles with a disregard of what color it is⁸.

- Searches for Dealers Near Me are back on the rise and hitting new record highs as people are open to searching multiple dealers to find a vehicle⁵. This points to an overall increase in lower-funnel intent in the marketplace.

-

- Upcoming sales events will fuel the fire even more

-

- Regardless of inventory we don’t expect consumers demand to pull back as they are primed to seek deals out around sales events — 55% say it is the best time to buy⁹. We also don’t expect brand messaging around these sales events to hold back — they didn’t during Presidents’ Day. This will just produce more intent and again buyers will search far and wide to when needing to purchase a vehicle.

-

Here are three actions plus a bonus topic your dealership should keep top of mind to find success in the current market conditions.

- Update your Digital Ad Strategy & Message daily to meet consumer demand and reflect changing inventory

- Dealers whose strategy moves at the speed of their inventory and vehicle offers will have a competitive edge in the market. Inventory and price are the top 2 influencers on which dealer people buy from¹⁰. Inventory is churning at unseen rates, the time it takes to update marketing to reflect what is coming in and out of the dealership could lose potential sales. Foundation Direct has our dealers covered as we create ads with the latest inventory down to the trim and price down to the penny all in real-time.

- Prioritize your dollars on the highest-intent in-market demand by leveraging the best intent signals & audience data

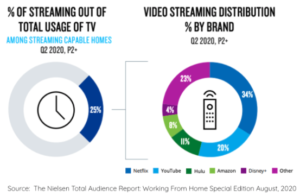

- Auto shoppers are entering and exiting the market everyday. Some make a decision in just weeks, while others research over months. Activating on the best, real-time audience data across devices is more important than ever. This is the reason why Foundation Direct’s strategy includes platforms like Google and Bing search to capture purchase intent as it happens — in your shoppers’ moments of highest intent; while YouTube and Facebook offer unmatched fresh in-market audience targeting that reaches 90% of auto shoppers¹¹.

- Shift dollars across Profit Center to support changing inventory levels

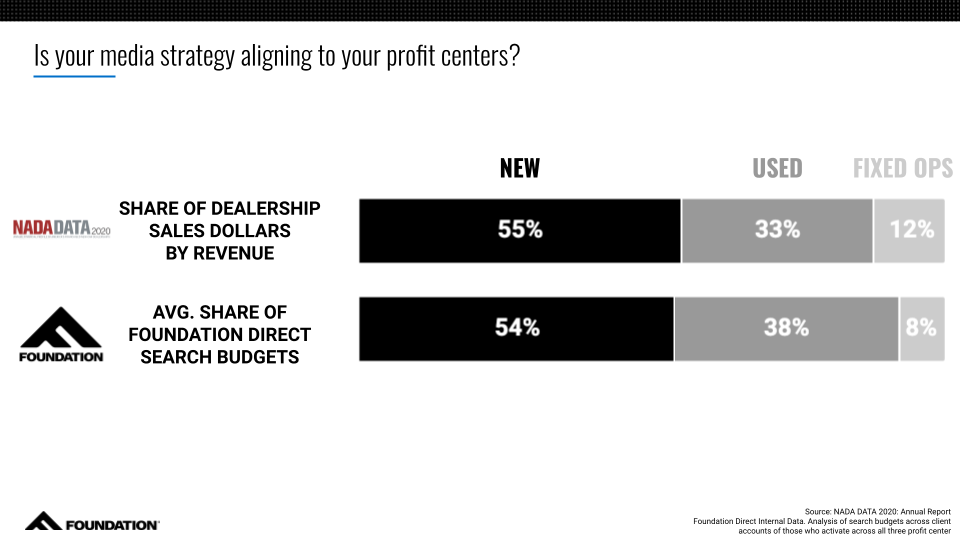

- NADA released their 2020 Annual Report, including a breakout of dealership revenue by profit center¹². Dealer revenue breakout: 55% new vehicle, 33% used vehicle and 12% service. Looking across our dealership accounts here at Foundation Direct, our search marketing budgets nearly perfectly align at 54% new vehicle, 38% used vehicle and 8% service¹³.

Foundation Direct customers only advertise on vehicles they have in stock (unless they tell us otherwise)

Foundation Direct customers only advertise on vehicles they have in stock (unless they tell us otherwise)

- NADA released their 2020 Annual Report, including a breakout of dealership revenue by profit center¹². Dealer revenue breakout: 55% new vehicle, 33% used vehicle and 12% service. Looking across our dealership accounts here at Foundation Direct, our search marketing budgets nearly perfectly align at 54% new vehicle, 38% used vehicle and 8% service¹³.

BONUS: You may be wondering if you should pause marketing. Here are our thoughts on why you shouldn’t.

Caveat: Foundation Direct does not take a margin on your media spend, but we want to make sure you don’t miss opportunities to connect with potential customers as demand continues to increase.

-

- Do I want to continue CAPTURING DEMAND to have conversations with potential buyers as demand continues to grow? (buyers are going to find a way to purchase a vehicle now from you or someone else). If so, review your media mix and continue with efficient strategies at the lowest part of the funnel with search and leaning into in-market audiences. Prioritize these opportunities over tactics that are CREATING DEMAND (TV ads, billboards, broad audience display targeting), which you can pull back on without sacrificing this-month’s sales.

- Search costs are likely to drop as other dealers pull back spend — just as we saw during the first months of COVID in 2021. Dealers who kept their marketing on last year experienced lower CPCs and rebounded faster by continuing to engage with customers.

- How can you leverage Fixed Ops to not only bring in revenue but as a lead for potential used vehicle acquisitions?

We at Foundation Direct strive to use data, technology and our expertise to deliver the best performance for our dealers. Not working with us, but interested in learning more? Reach out!

Contributors:

Michael Heidner |

Ashley Lepczyk |

Andrew Diffenderfer |

Ashlyn Stewart |

Sources:

1 J.D. Power and LMC Automotive – “April New-Vehicle Sales to Break Record Despite Low Inventory; Buyers Will Spend More on New Vehicles Than Any Other April“

2 Average of forecasts from NADA, COX Automotive, IHS Market POLK, J.D. Power Sales Data Release, Ward’s Automotive Intelligence

3 Wards Intelligence – U.S. Light Vehicle Inventory, March 2021

4 CNBC.com – “Car shoppers should expect high prices and limited inventory this spring“

5 Google Trends, 2021 – “Dealers near me” and “Dealerships near me” searches

6 Google Dealer Guidebook 2.5 ThinkWithGoogle.com

7 J.D. Power and LMC Automotive – “J.D. Power and LMC Automotive U.S. Automotive Forecast for March 2021”

8 Bloomerberg.com – “Buyers Snapping Up New Cars, Even If They’re the Wrong Color”

9 Mintel Report – “Car Purchasing Process – US – July 2019”

10 Automotive News Power Training – “Google’s Dealer Guidebook 2.5 Prepares Dealers for the Future”

11 comscore Media Metrix, 2021

12 NADA DATA 2020: Annual Report

13 Foundation Direct Internal Data, 2021